- +234-810-059-8276

- info@fullrangemfb.com

- Mon - Fri: 8:00 - 05:00

About Fullrange Loan

Fullrange Microfinance Bank offers entrepreneurs the opportunity to easily access loans in a quick, transparent and efficient environment. We offer business owners of Small and Medium Size Enterprises the opportunity to access loan products in a quick, transparent and efficient way.

Building on our global expertise and attaining international standards, we can assure our clients highest quality service and delivery. Prospective borrowers can save money with Fullrange Microfinance Bank and also apply for a loan, as we do not support forced savings. All that is needed is an existing, viable business.

What sets FULLRANGE Microfinance Bank apart is primarily the efficiency and ease of access to credit facilities. Documentation and collateral requirements are significantly more flexible than anywhere else in the Nigerian banking sector, and the processing time is the shortest available.

Our Loans currently range from ₦20,000 to ₦5,000,000 with a minimum tenor of 1 month and a maximum tenor of 18 months.

Features & Benefits

- Flexible collateral arrangements depending on loan size (household goods, business equipment, goods in stock, vehicles, property etc.)

- Flexible documentation requirements.

- Long-standing clients with impeccable repayment record qualify for successive interest rate discounts and even faster loan processing.

- SMS reminder for your monthly repayments

🏦 Our Loan Products

Flexible financing solutions tailored to your needs

SME Finance

Credit product designed specifically to support Small and Medium Scale Enterprises (SMEs) operators in Nigeria.

Learn More

LPO Financing Loan

Account meant for customers with Genuine LPO (Local Purchasing Order) for financing their businesses and investments.

Learn More

Auto Loans

Consumer credit scheme for qualified individuals to part-finance acquisition of cars, motor cycles, Maruwa and more.

Learn More

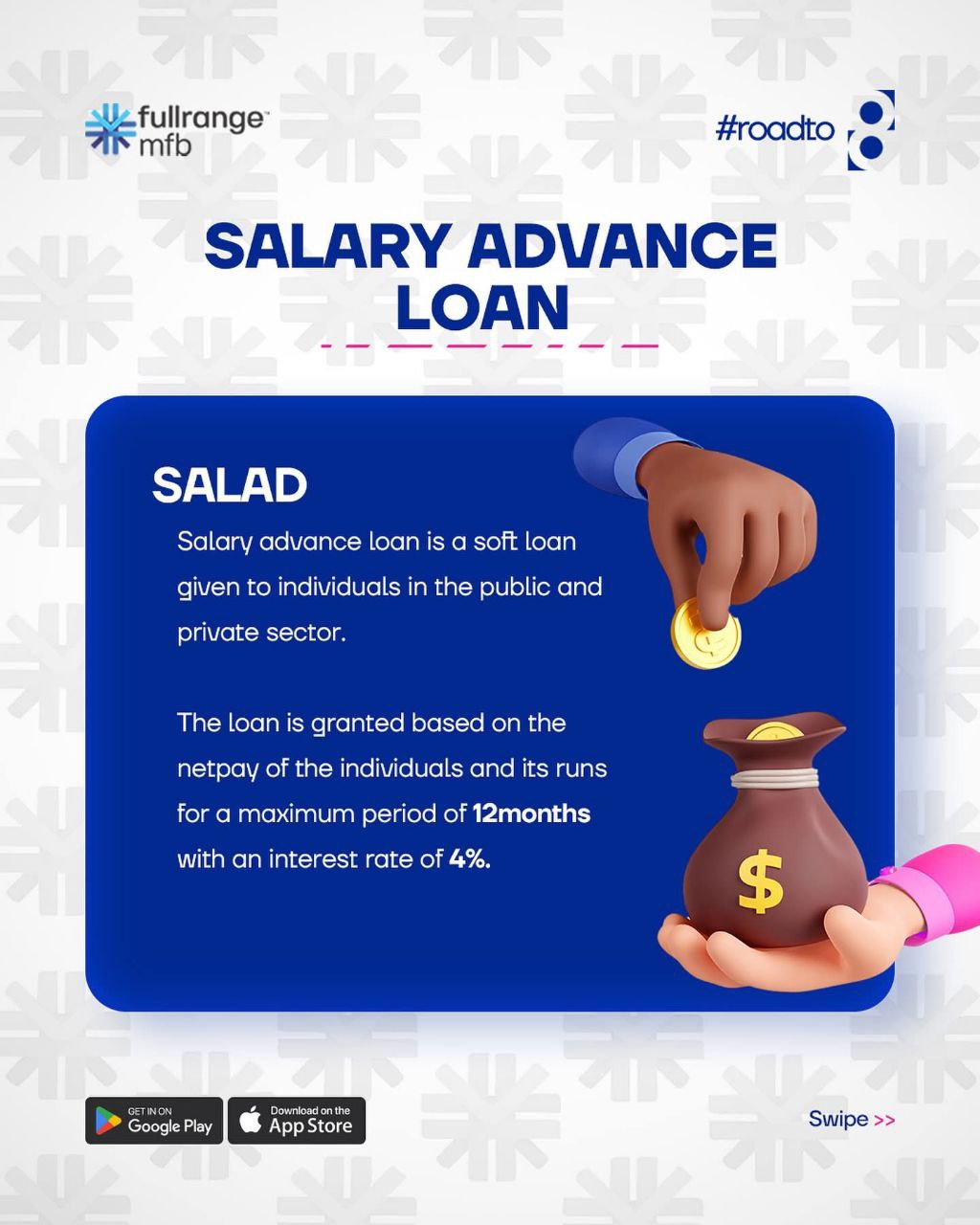

Salary Advance

Access either short or medium-term funding to satisfy your personal financial needs with flexible repayment options.

Learn More

Back to School Loan

Quick loan designed to support parents in payment of children/wards' fees especially when cash-strapped.

Learn More

Group Loan

Micro-finance Bank Nigeria offers traders the opportunity to easily access loans in a quick, transparent and efficient environment.

Learn More

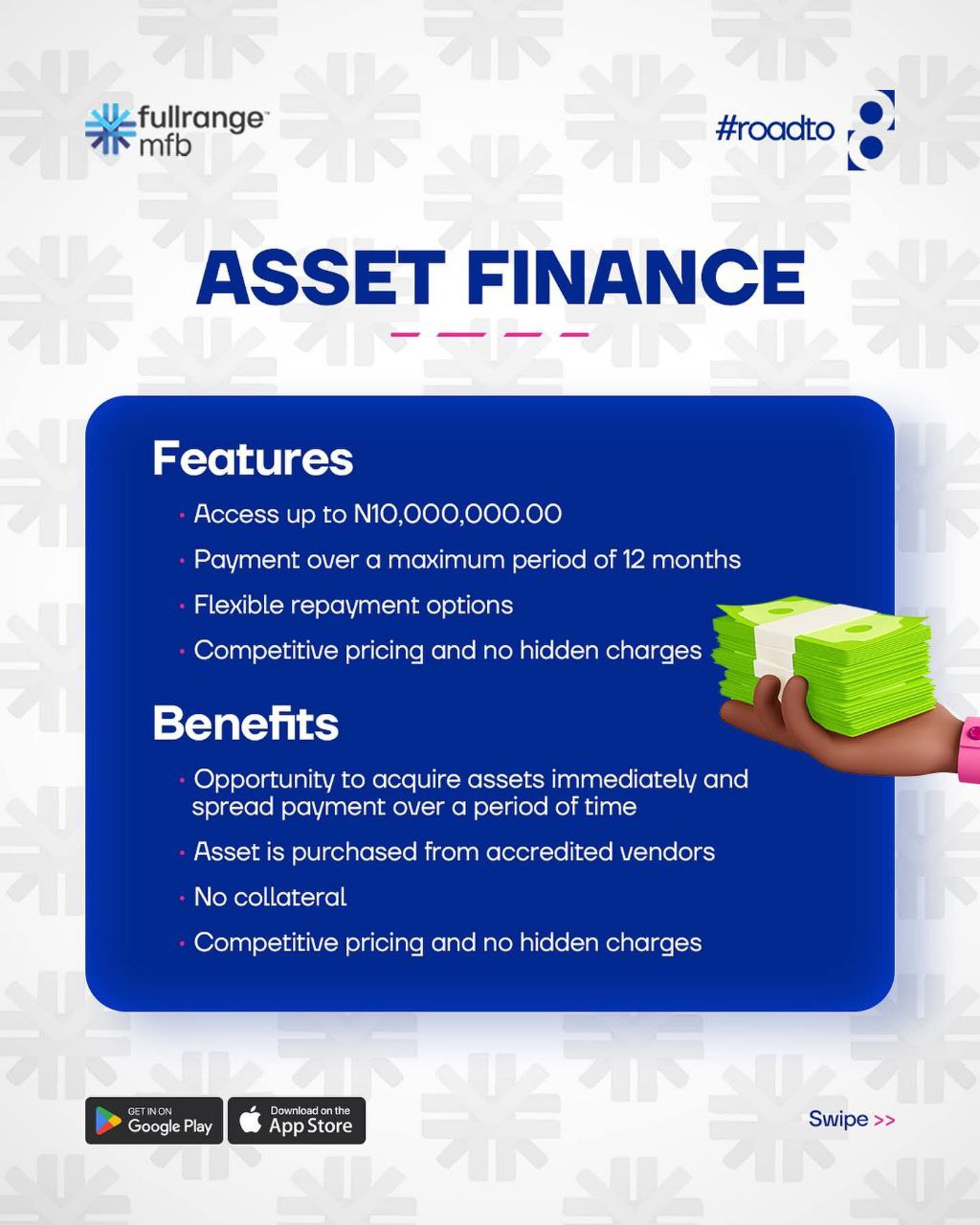

Asset Finance

Convenient and affordable means of owning household appliances and equipment for your comfort and productivity.

Learn More

Micro Loans

Taking care of all our customers need is priority and bringing banking transactions to their door steps.

Learn More